Securing funding is the lifeblood of any small business, but unlike established corporations, securing loans can feel like a tightrope walk without a safety net. Credit scores, the financial equivalent of a report card, become the gatekeepers to the capital you need to thrive. Lenders analyze these scores to assess risk and make loan decisions, leaving many small businesses wondering how to navigate this complex system for credit scoring for small businesses.

Enter Nected your game-changer in the credit scoring landscape. Forget traditional complexities – their innovative No Code/Low Code Rule Engine empowers you to seamlessly build and customize credit scoring rules tailored to your business needs. This user-friendly approach flips the script, putting the power of credit assessment in your hands.

The Basics of Small Business Credit Score

Credit scoring is a numerical representation of a business's creditworthiness, which helps lenders assess the risk of extending credit. Small business credit scores differ from personal credit scores and are determined by various factors, including:

- Payment History (30-35%): Timely payments to vendors, loans, and credit cards significantly impact your score. Late payments or delinquencies are heavily penalized.

- Credit Utilization (20-25%): Keeping credit card balances low compared to credit limits (ideally, below 30%) shows responsible management of debt.

- Business Age and Credit Mix (15-20%): A longer track record of responsible credit use boosts your score. Having a diverse mix of credit accounts (e.g., loans, lines of credit) also demonstrates financial flexibility.

- Public Records (10-15%): Negative events like bankruptcies, liens, or judgments significantly hurt your score.

- Industry Risk (10-15%): Some industries are inherently riskier, which can affect your score even with good individual performance.

Exploring Small Business Credit Scoring Models

Credit scoring models for small businesses are used by lenders to assess the creditworthiness of a business. These models take into account various factors such as payment history, age of credit history, debt and debt usage, industry risk, and company size. Business credit scores are determined using these factors, and a higher score indicates a lower risk for lenders.

Small business owners can access their business credit scores from the three major business credit bureaus (Dun & Bradstreet, Experian, and Equifax) for a fee. Establishing good credit scores is important for small businesses as it helps them negotiate favorable terms with suppliers, establish lines of credit with banks, and qualify for small business loans.

The Role of Credit Scoring System for Small Business Loans

Credit scoring plays a crucial role in small business loans as lenders use credit scores to determine the creditworthiness of a business. A higher credit score indicates a lower risk for lenders, making it easier for small businesses to access financing at lower interest rates. Business credit scores also help small businesses keep their personal finances separate from their business finances, which is important for tax purposes. In the absence of a business credit score, a strong personal credit history is required to qualify for a small business loan based on personal credit alone.

Small business credit scoring models, such as those offered by Nected, provide lenders with a more comprehensive and accurate assessment of a small business's creditworthiness, enabling them to make informed lending decisions.

How Nected Simplifies Credit and Lending Decisions for Small Businesses

Challenges:

- Traditional credit and lending infrastructure is inflexible and slow to adapt, hindering decision-making agility.

- Building complex logic with diverse data sources for accurate decisions is difficult and time-consuming.

Nected's Solutions:

1. Centralized Data Integration

- Aggregates credit scores from various bureaus (CIBIL, CRIF, Equifax) via APIs.

- Merges internal data points from different sources using a low-code editor.

2. Intuitive Decision-Making

- Low-code/no-code platform allows building complex eligibility criteria without needing technical expertise.

- Tailors loan criteria to specific scenarios for targeted decision-making.

3. Real-Time Adaptability

Dynamic rules based on live data provide real-time creditworthiness assessments. Modify rules on-the-fly without external dependence, ensuring agility in changing markets.

4. Personalized Experiences

Craft customized recommendations for smoother application experiences.

Nected: Solutions for Small Business Credit Scoring

Nected’s rule engine is designed to be user-friendly, accessible, and customizable, catering to small businesses' unique needs. This No-code/ low-code credit scoring platform allows users to create and deploy credit scoring models without extensive coding knowledge.

Features

- Accessibility & Ease: Nected's user-friendly interface makes it simple to utilize, even without extensive technical knowledge. No coding required!

- Flexibility & Customization: Tailor credit scoring models to your specific needs, incorporating alternative data sources like e-commerce transactions or accounting data.

- Transparency & Openness: Gain clear insights into how credit scores are calculated, building trust and understanding. Open-source platform fosters collaboration and innovation.

- Cost-Effectiveness: Eliminate expensive licensing fees with the open-source model, making it accessible to small businesses and startups.

- Innovation & Collaboration: Contribute to the platform's development alongside a global community, driving advancements in credit scoring practices.

Benefits for Small Businesses

- Faster loan approvals: Streamlined decision-making reduces processing time.

- Improved access to credit: Flexible criteria cater to diverse business needs.

- Reduced costs: Eliminates the need for expensive IT resources and complex infrastructure.

- Enhanced competitiveness: Real-time adaptability allows quicker response to market changes.

- Personalized offerings: Tailored recommendations improve customer satisfaction.

Nected's scalability caters to growing businesses, empowering them to handle increasing complexity and customization demands. Nected empowers small businesses with a user-friendly platform to make faster, more informed credit and lending decisions, ultimately contributing to their sustainable growth.

Implementing Credit Scoring for Small Business with Nected

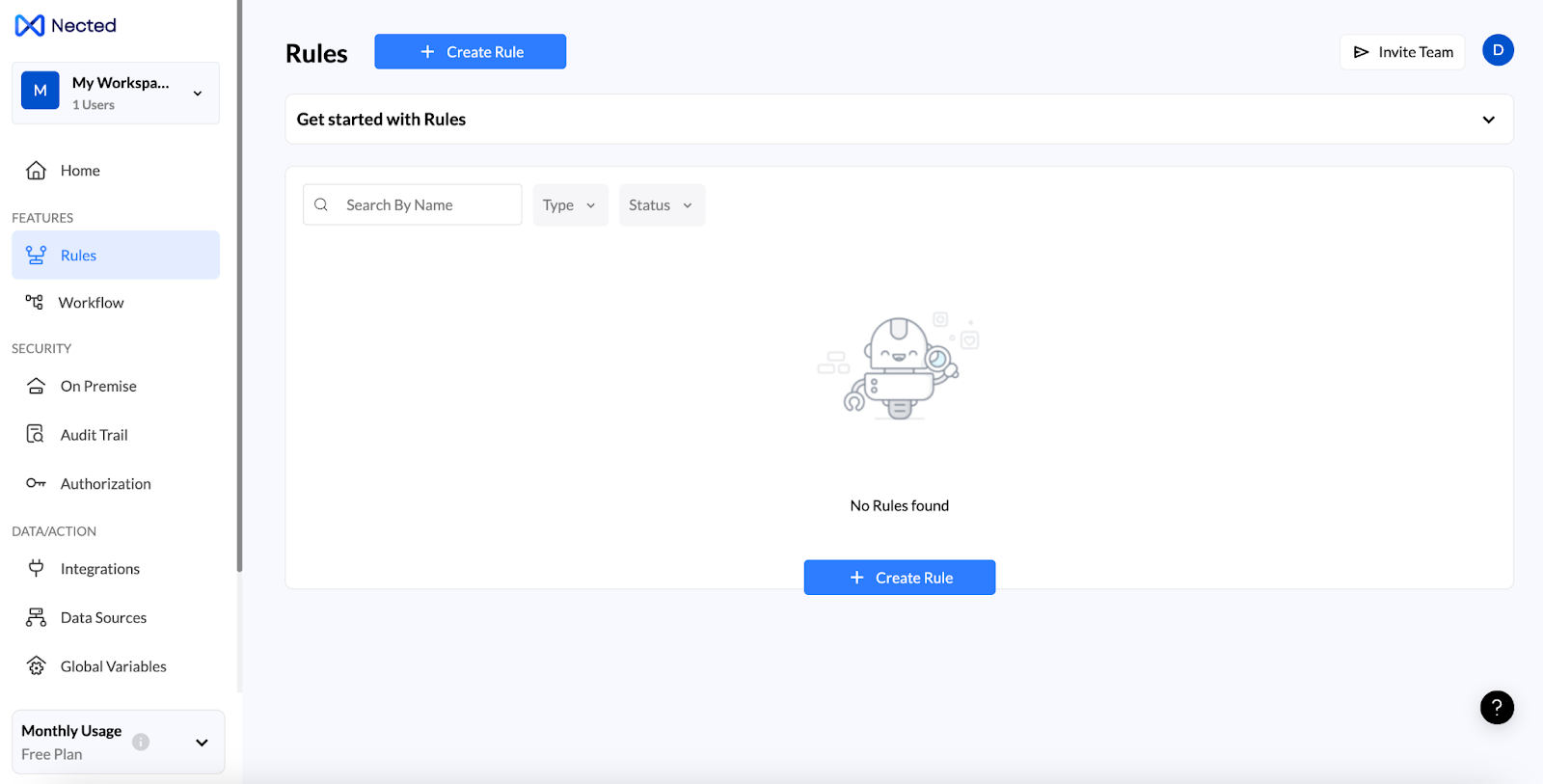

Step 1: Navigating the Nected Interface to Login

Step 2: Initiating a New Project

Step 3: Data Integration

Step 4: Rule-Based Model Creation

Utilize Nected's rule-based approach to create credit scoring models for small businesses. Define rules based on selected features and parameters, such as payment history, credit utilization, and length of credit history.

Nected's low-code environment makes it easy to create these rules without requiring advanced coding skills.

By leveraging Nected's rule-based approach, you can create customized credit scoring models that are tailored to the needs of small businesses.

Step 5: Testing and Validation

Test the credit scoring model within Nected to validate its accuracy and reliability. Ensure that the model aligns with the expected outcomes, such as predicting creditworthiness accurately and providing actionable insights for small businesses.

By testing the credit scoring model, you can identify any issues or inaccuracies in the model and make adjustments as needed. This will help ensure that the model aligns with the expected outcomes and provides value to small businesses.

Step 6: Deployment

Once you are satisfied with the testing phase, deploy your credit scoring model through Nected with ease. Nected's deployment capabilities ensure a smooth transition from development to practical application, making it easy for small businesses to access and benefit from your credit scoring model.

By deploying the credit scoring model through Nected, you can ensure that small businesses have access to accurate credit scores and actionable insights. So, what are you waiting for? Signup now!

Conclusion

In today's dynamic economic environment, mastering credit scoring is essential for small businesses to access financing, negotiate better terms, and maintain positive relationships with vendors and suppliers. Nected's innovative credit scoring for small business solutions have revolutionized the way small businesses approach credit scoring, providing them with personalized insights and actionable recommendations to make informed financial decisions.

By leveraging Nected's credit scoring platform, small businesses can establish and maintain a strong credit profile, enabling them to access financing at lower interest rates, negotiate better terms, and grow sustainably. Try Nected today and unlock your full potential for growth and success. Nected is committed to small business financial health, empowering you to master credit scoring and make informed financial decisions.

FAQ’s

Q1. Explain credit scoring in reference with small business?

Credit scoring for small businesses is a measure used by lenders to calculate the likelihood of a business repaying its debts and the risk associated with extending credit to the business. This process typically results in a numerical score that reflects the business's credit risk, based on various financial factors and payment history.

Q2. What is the importance of credit scoring for small businesses?

For small businesses, a strong credit score isn't just a number, it's a key to future success. It directly impacts their ability to access funding, secure favorable terms from suppliers, and build a trustworthy reputation. Imagine lenders offering better rates, vendors extending generous payment terms, and clients flocking to collaborate with a financially responsible business – this is the power of a good credit score. It becomes a golden handshake, opening doors to capital, fostering growth, and solidifying your competitive edge.

Q3. How is credit scoring different for small businesses compared to individuals?

While personal credit scores focus solely on an individual's financial history, small business scores delve deeper, analyzing the company's payment patterns across loans, trade credit, and even public records. Additionally, industry risk and business size come into play for companies, unlike individual assessments. This multi-faceted approach creates a distinct system for evaluating the financial health and loan repayment risk of a small business, compared to individual credit scoring.

Q4. What factors influence a small business's credit score?

A. Just like you have a personal credit score, your small business has one too! Several things affect your business score, like paying bills on time, not using too much credit, and staying out of legal trouble. The size of your business, the industry you're in, and how long you've been around also matter. Even the owner's personal credit score can play a role!

.svg)

.svg)

.png)

.svg)