Credit scoring is a crucial process that banks, lenders, and financial institutions use to evaluate the risk associated with lending money to individuals. It helps determine whether a person will likely repay a loan or credit card debt based on past financial behavior. If you want to leverage credit scoring with python to handle large databases, this blog is for you.

Embarking on the landscape of credit assessment, Python emerges as a powerful ally, reshaping the way credit scoring models come to life. In the realm of "Credit Scoring Python," this blog serves as your technical guide, steering financial analysts and data enthusiasts through the nuanced process of constructing robust credit scoring models. From detailed data preparation to the seamless integration of predictive analytics, Python takes center stage, empowering professionals in finance and tech.

Our journey delves into the intricacies of credit scoring model python and credit scoring machine learning, unraveling the art of model selection, training, and the effortless incorporation of predictive analytics. In the following sections, we confront the challenges of crafting sophisticated credit scoring models with Python and we will also check about a low-code no-code tool Nected, a transformative tool poised to simplify this intricate process. Get ready to immerse yourself in the synergy of finance and technology as we unveil the profound impact of Python on revolutionizing credit scoring methodologies.

Building a Credit Scoring Model with Python

Let's embark on building a basic credit scoring model using Python. In this simplified example, we'll create a function that calculates a credit score based on parameters such as age, income, and debt. The goal is to provide a numerical representation of an individual's creditworthiness.

In this basic example, we've considered additional parameters like credit history and employment status, each with its own weight. The function returns a credit score within the range of 350 to 800.

Now, as we delve into more realistic scenarios and larger datasets, the credit scoring process becomes more intricate, involving thorough data preparation, sophisticated model selection and training, and seamless integration of predictive analytics techniques.

The process unfolds through three meticulously crafted phases: Data Preparation, Model Selection and Training, and Predictive Analytics Integration. Let's delve into each phase with a granular perspective.

Data Preparation

The foundation of any robust credit scoring model lies in meticulous data preparation. Python, equipped with Pandas, provides a toolkit for efficient data manipulation. The following code snippet illustrates a comprehensive data cleaning and preprocessing routine:

This code snippet showcases the essential steps of loading the dataset, handling missing values, encoding categorical variables, and normalizing numerical features. A clean and well-structured dataset is imperative for accurate model training.

Model Selection and Training

Python, with its rich ecosystem of machine learning libraries, facilitates an array of model selection options. Let's delve into an example using the Random Forest Classifier, a popular choice for credit scoring:

In this snippet, we create a Random Forest Classifier, train the model, make predictions, and evaluate accuracy. Python's Scikit-Learn library simplifies complex machine learning workflows, enabling analysts to choose and train models with ease.

Predictive Analytics Integration

Python seamlessly integrates predictive analytics into the credit scoring model. Leveraging libraries like Statsmodels, we can delve into the interpretability of the model. Below is an example using logistic regression:

This code showcases the integration of a logistic regression model using Statsmodels, providing insights into coefficients, p-values, and overall model significance. Python empowers analysts to seamlessly blend predictive analytics into the credit scoring journey, ensuring an informed and interpretable model.

In this detailed exploration, we've traversed the intricate phases of building a credit scoring model with Python, emphasizing the importance of data preparation, model selection, and predictive analytics integration. Stay tuned as we unravel the challenges associated with complex credit scoring models and discover how Nected simplifies this intricate process.

Challenges of Building Complex Credit Scoring Models using Python

The process of building complex credit scoring models using Python is not without its challenges. Navigating these challenges is crucial to ensuring the accuracy and reliability of the credit scoring system. Here are some of the key challenges associated with building complex credit scoring models:

1. Large Database Issues: Credit scoring often involves dealing with large datasets containing diverse customer information. Python may encounter challenges when handling extensive databases, leading to potential performance bottlenecks and increased memory requirements.

2. Normalization Challenges: Normalizing data, a crucial step in credit scoring, can be challenging in Python. Ensuring that data across different scales and units are standardized for fair assessment requires careful implementation, especially with diverse data types.

3. Model Interpretability: Many machine learning models, including those used in credit scoring, are considered "black-box" models, making it challenging to interpret their decisions. Ensuring transparency and interpretability for regulatory compliance and stakeholder understanding becomes a crucial challenge.

4. High Learning Curve: Implementing machine learning algorithms for credit scoring in Python requires a high level of technical expertise. The learning curve can be steep for professionals not well-versed in Python and machine learning, potentially hindering the adoption of advanced credit scoring techniques.

5. Computation Time Issues: Python, while versatile, may face computation time challenges when dealing with complex credit scoring models, especially with large datasets. Ensuring efficient execution becomes a critical concern for real-time credit assessments.

6. Data Security Concerns: Credit scoring involves handling sensitive financial data. Python, being an open-source language, may pose security concerns in terms of data privacy and protection. Implementing robust security measures becomes imperative to address potential vulnerabilities.

7. Scalability Challenges: As the volume of credit data grows, ensuring the scalability of Python-based credit scoring models becomes crucial. Managing increased computational demands and adapting to evolving business needs present scalability challenges in Python implementations.

8. Regulatory Compliance: Adhering to regulatory requirements in credit scoring models is paramount. Python may face challenges in keeping up with evolving regulatory frameworks, requiring constant updates and adaptations to ensure compliance.

These challenges underscore the importance of addressing both technical and regulatory aspects in the development and implementation of credit scoring models using Python.

How does Nected create the same complex credit scoring Model easily?

Implementing complex credit scoring models is made significantly more straightforward with Nected, thanks to its user-friendly features and robust capabilities.

Here is a step by step implementation with Nected:

Step 1: Logging In

Begin by logging into the Nected platform with your credentials. Access the user-friendly interface designed for intuitive navigation.

Step 2: Versatile Data Integration

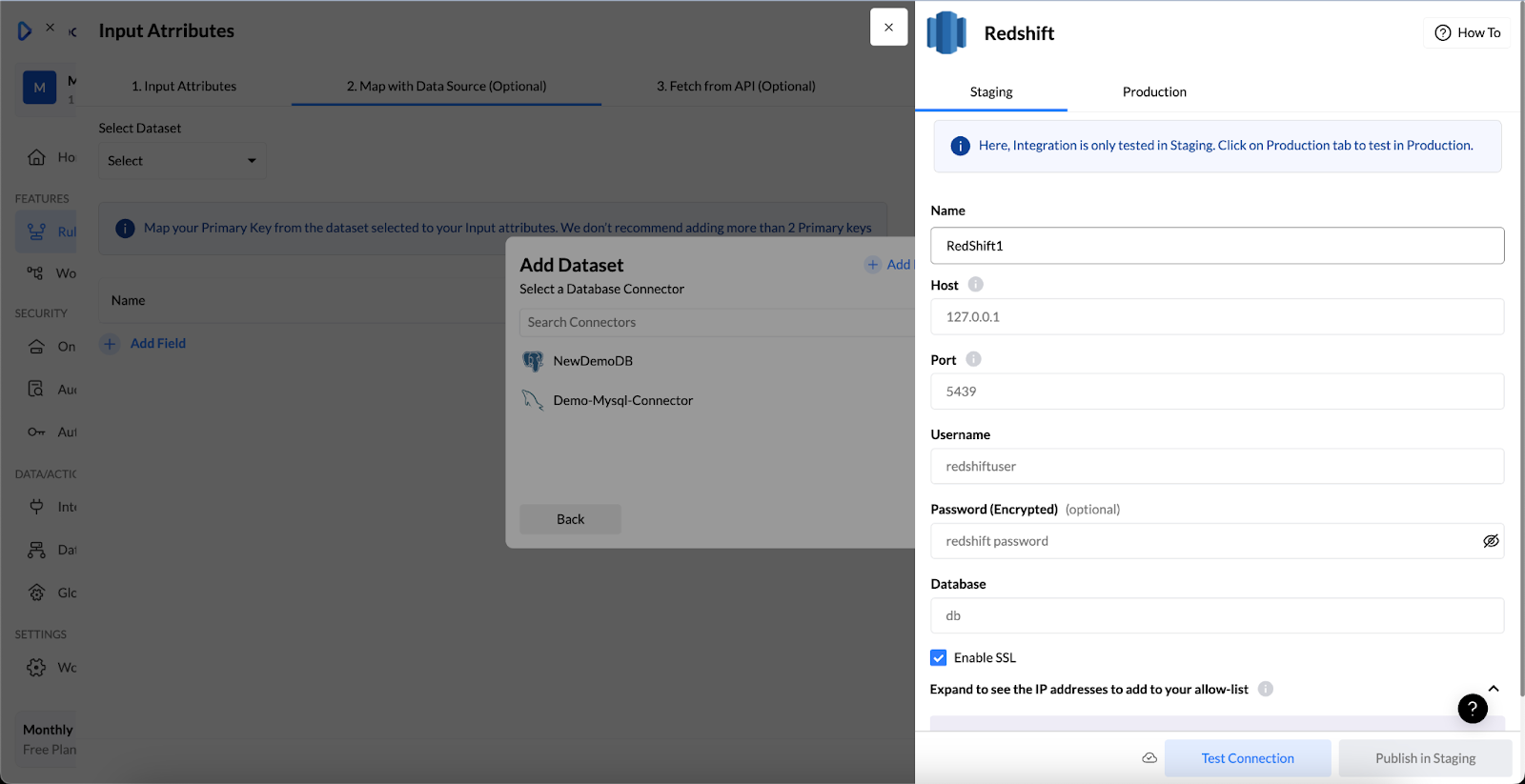

Nected's data integration capabilities shine as you connect seamlessly with Amazon Redshift. Nected's platform versatility is shown by pulling in diverse data from the organization's data warehouse. From traditional financial data like credit history and income to non-traditional sources such as social media activity, Nected ensures a comprehensive dataset for enhanced predictive analytics.

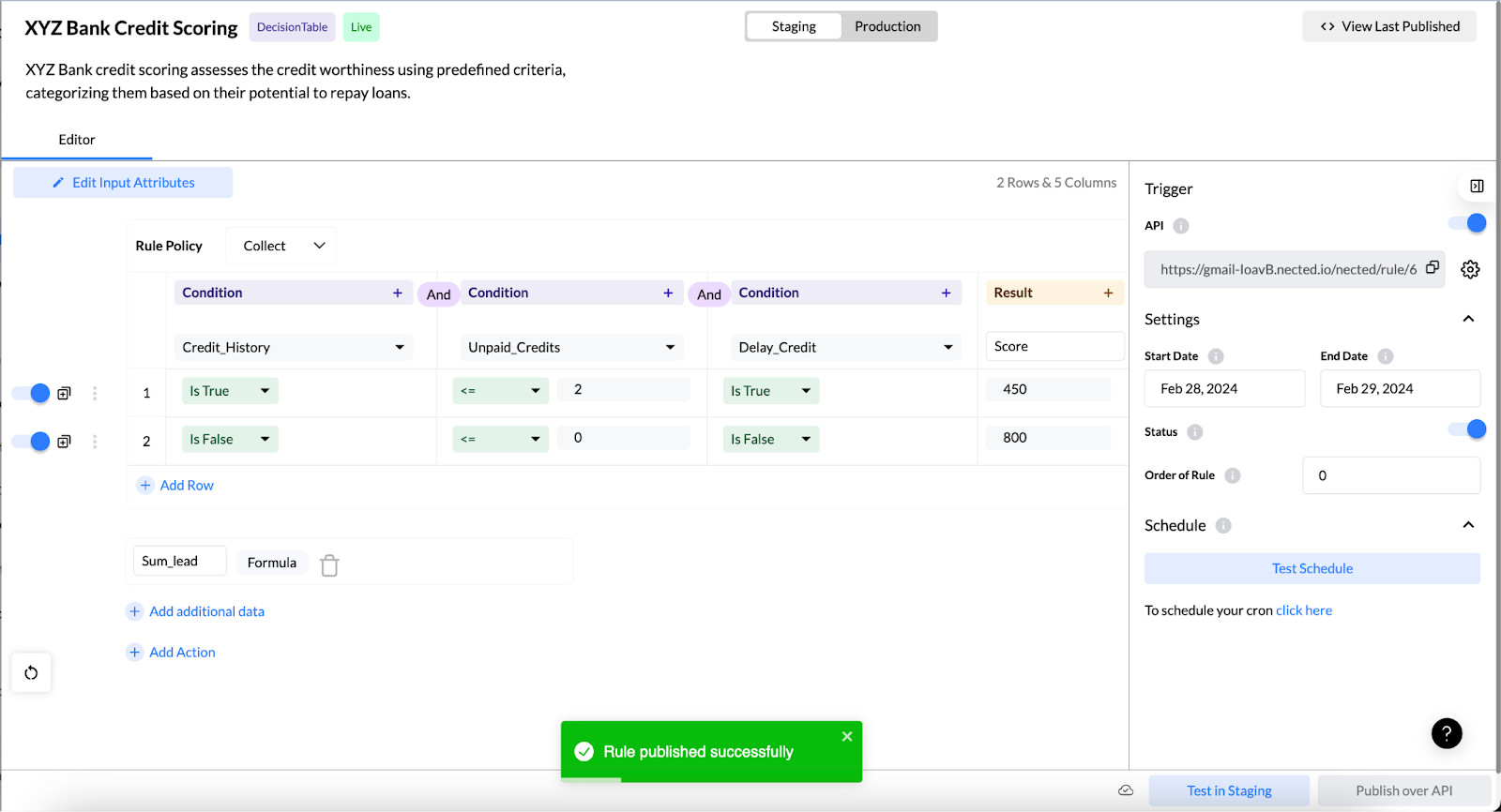

Step 3: Rule Creation

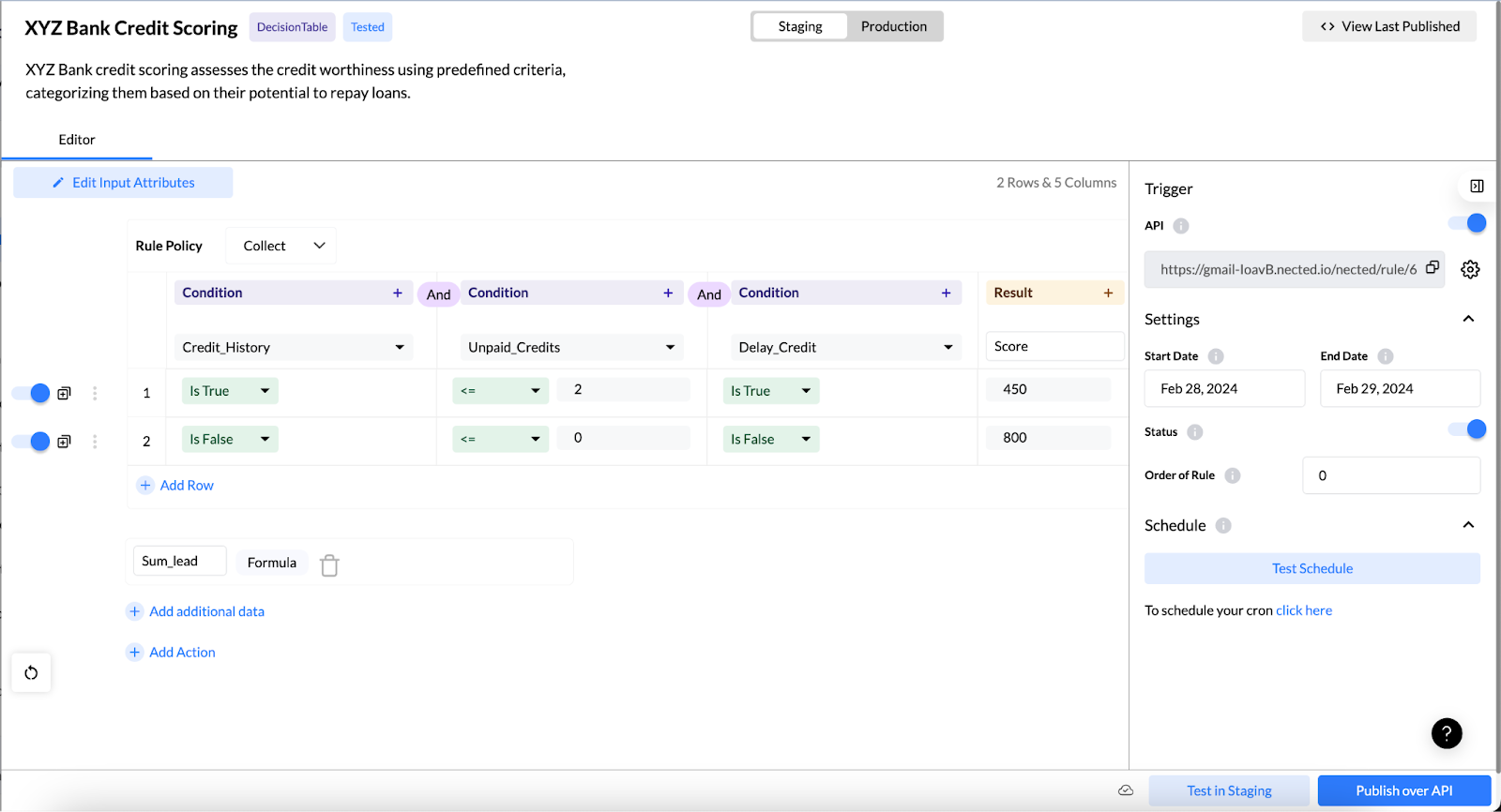

Create a custom rule within Nected to tailor the predictive analytics credit scoring model. Utilize the platform's low-code, no-code features to establish specific parameters aligning with business criteria. This step allows for rule-based customization without the need for extensive coding.

Step 4: Testing and Validation

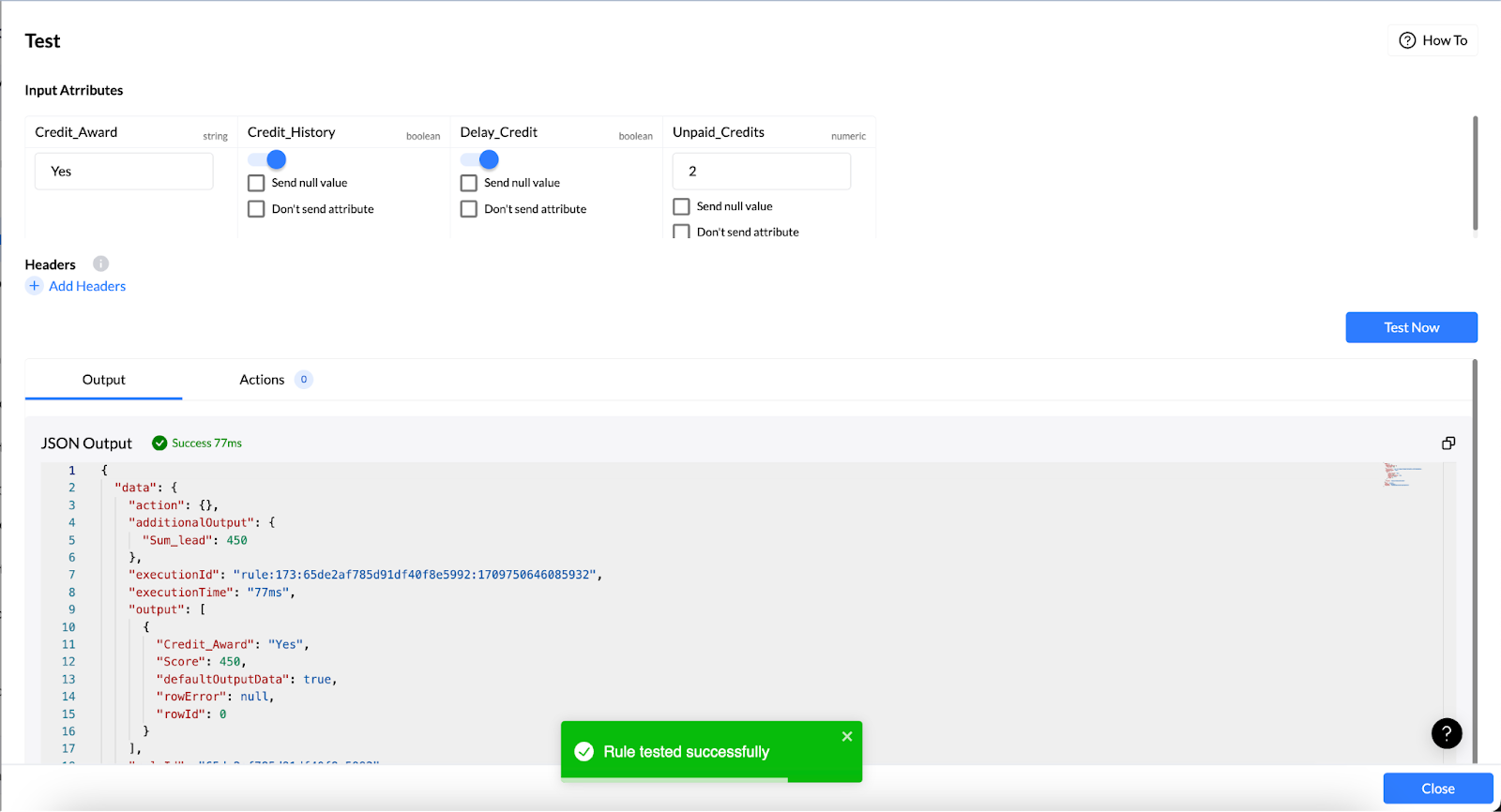

Rigorously test the developed model within Nected to confirm accuracy and reliability. Ensure that the model aligns with historical data, where outcomes are known, before proceeding to deployment.

Step 5: Deployment

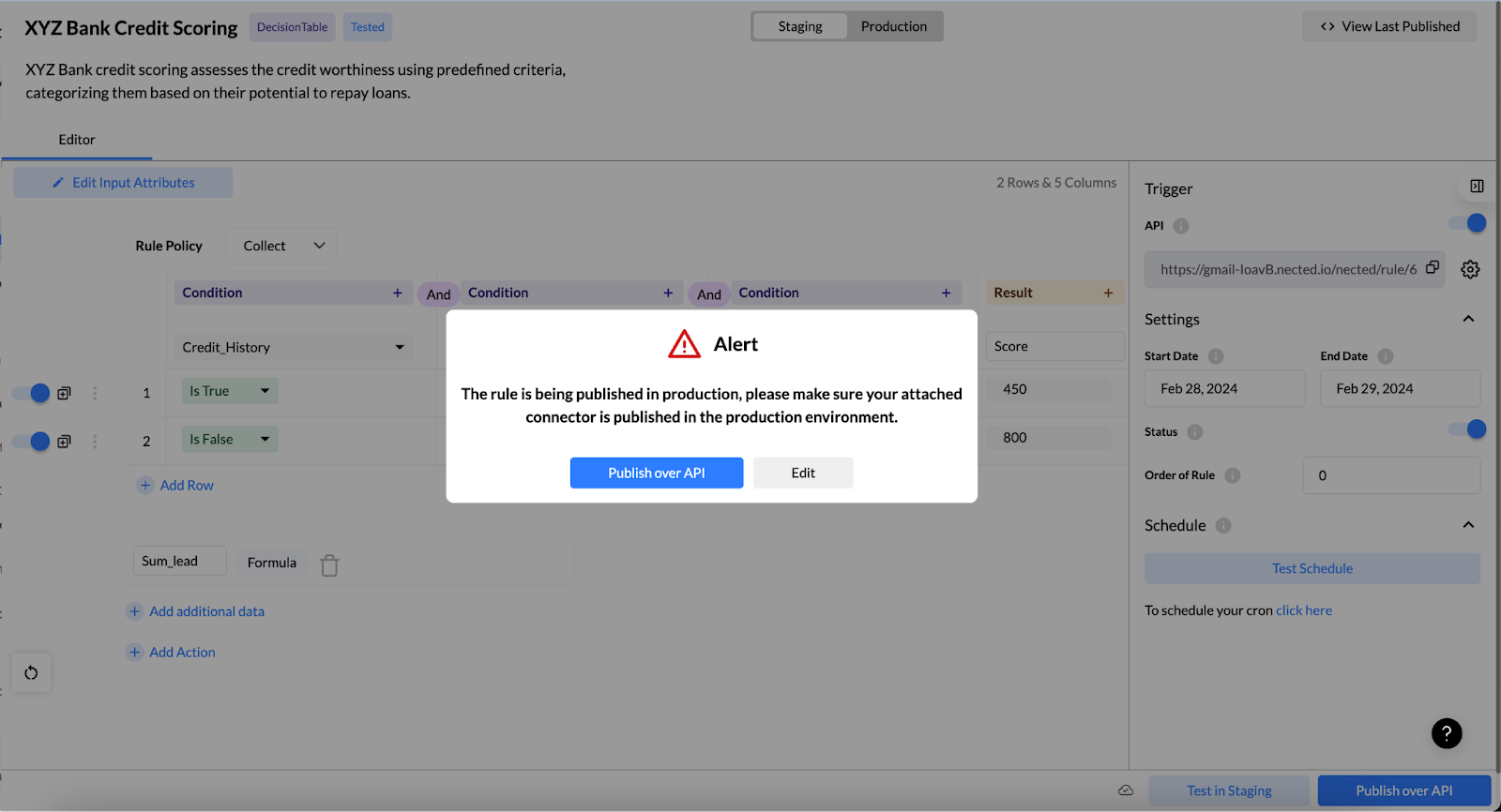

Once satisfied with the testing results, deploy the credit scoring model using Nected. Benefit from streamlined workflows for a swift integration into organization's lending processes.

Nected's user-friendly interface facilitates the implementation of credit scoring without the need for extensive coding or data science expertise.

Why use Nected for Creating Credit Scoring Model?

Let's take a quick look on why you should choose Nected for creating credit scoring models:

1. Scalability Considerations: As your business grows, Nected adapts to changing demands seamlessly. The platform is designed to handle a variety of credit applications, ensuring scalability. Whether dealing with a small number of applicants or processing a large volume of credit data, Nected's scalability feature supports your business expansion.

2. Real-time Rule Execution: Take advantage of Nected's real-time rule execution capability. This ensures that credit scoring decisions are based on up-to-date information, crucial for scenarios where quick lending decisions are imperative, such as in small business credit assessments.

3. User-Friendly Interface: Navigate through Nected's user-friendly interface, which caters to professionals with different levels of technical expertise. The design is intuitive, providing a seamless experience as you work through the various steps of implementing credit scoring models.

4. Integration with External Tools: Enhance the functionality of your credit scoring models by integrating Nected with external tools like Gsheet and Slack. This connectivity expands the capabilities of your credit assessment process, allowing for a more comprehensive and tailored approach.

Conclusion

In conclusion, the exploration of credit scoring with Python has unveiled the intricacies involved in assessing creditworthiness. From data preparation to predictive analytics integration, Python empowers financial institutions to navigate the complexities of building credit scoring models.

Despite challenges like the high learning curve and computation time issues, Python remains a robust tool. However, the advent of Nected has transformed this landscape, providing a simplified and streamlined solution. Nected's user-friendly interface, seamless data integration through connectors, and no-code/low-code rule creation make credit scoring more accessible. The platform's scalability and real-time execution further contribute to efficient credit assessment.

As industries evolve, Nected stands as a transformative approach, addressing challenges and offering a more efficient, scalable, and user-friendly credit scoring process. Financial institutions can confidently embrace Nected, anticipating streamlined workflows and enhanced operational processes in the realm of credit scoring.

FAQs

Q1: How can I get started with credit scoring using Python if I'm new to programming?

If you're new to programming, start by learning the basics of the Python programming language through online tutorials, courses, or books. Once you're comfortable with Python syntax and concepts, you can dive into specific libraries and tools for data analysis and machine learning, such as Pandas, NumPy, scikit-learn, and TensorFlow.

Q2: What are some key libraries and tools in Python that are commonly used for credit scoring?

Commonly used libraries and tools for credit scoring in Python include Pandas for data manipulation, NumPy for numerical computing, scikit-learn for machine learning algorithms, TensorFlow or PyTorch for deep learning, and Matplotlib or Seaborn for data visualization.

Q3: How do I preprocess and clean data for credit scoring projects using Python?

Data preprocessing and cleaning are essential steps in credit scoring projects. In Python, you can use Pandas for tasks such as handling missing values, removing duplicates, scaling features, encoding categorical variables, and more. Additionally, libraries like scikit-learn provide tools for feature selection and transformation.

.svg)

.svg)

.png)

.jpg)

.svg)