Underwriting teams lack a fast, auditable way to change score rules—delaying offers and costing revenue.

Excessive manual reviews increase operational cost and slow approvals—eroding conversion at checkout.

.webp)

Rigid scorecards ignore real-time signals such as device risk, behavior, or recent payment events—reducing approval accuracy.

.webp)

Teams lack accurate sandboxes to simulate score changes against historical portfolios, causing financial and compliance risk.

Legacy scoring systems fail under peak traffic and cannot support thousands of concurrent decisions per second.

Integrating bureau data, device signals, and transactional feeds requires custom engineering and long timelines.

Empowers credit, product, and risk teams to define, test, and version scorecards without developer cycles.

Configure promotional score relaxations, partner offers, or seasonal risk controls and launch across channels in hours.

Tailor score thresholds and treatment plans per channel, cohort, or campaign to safely increase approvals and retention.

Run historical replays, A/B cohorts, and real-time scoring at millisecond latency—scale up to 100k decisions/min with predictable performance.

.webp)

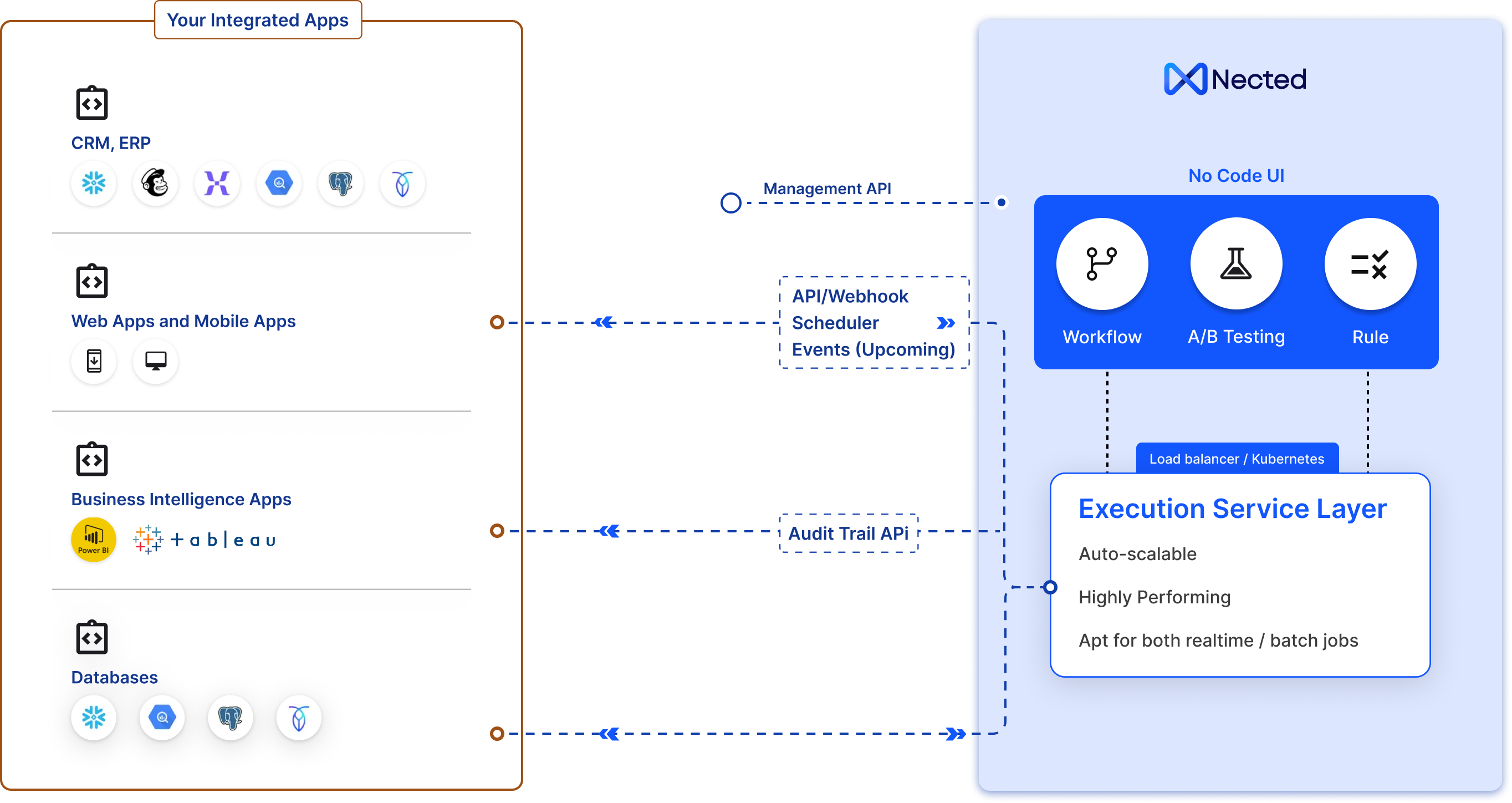

Seamlessly integrate with any system using simple API-based connectors. No need for complex configurations—connect databases, third-party services, and internal tools with just a few clicks.

.webp)

Leverage a powerful rule engine with multiple rule types, including Simple Rules, Decision Tables, Decision Trees, Rule Sets, and Rule Chains to handle complex logic effortlessly.

.webp)

Automate workflows with Action, Rule, Workflow, Code, Database, and REST API Nodes, while Loop, Delay, and Switch Block manage execution.

Efficiently oversee the entire rule and workflow lifecycle with built-in versioning, rollback capabilities, and staging environments, ensuring seamless transitions from testing to production without disruptions.

.webp)

Deploy Nected anywhere—choose multi-region cloud hosting for high availability or self-host on your infrastructure for complete control and compliance.

Gain full visibility into your decision rules and workflows with audit trails features, and real-time dashboards. Stay compliant and track every change with ease.

Deliver a fully white-labeled experience with embedded user functionality. Use Nected as your own branded decision engine.

Operate with confidence using enterprise-level security, role-based access control, and scalable infrastructure that ensures data integrity and performance even at scale.

Deploy intelligent AI Agents to automate document extraction, text classification, data enrichment, or any other domain-specific task. Build your own agents or plug in pre-trained ones directly into your workflows.

Integrate APIs, databases, and AI models like OpenAI or Vertex in minutes—no coding, just simple drag-and-drop setup.

Faster business iteration, lower TCO, and deeper API orchestration. Unlike monolithic rule engines, Nected provides a visual, no-code rule builder with versioning, pre-built connectors to lending CRMs and bureaus, and orchestration to run real-time decisions across channels. You get Pega-level enterprise governance (RBAC, audit trails, rollback) with DecisionRules-style lightweight deployment speed—plus the ability to scale to 100,000 decisions/minute and run hybrid cloud or on-prem deployments.

From concept to production in under a week. Business teams can author rules, simulate in sandbox with historical data, and promote to production with full audit and rollback. Typical rollout for a new scorecard: 1–3 days for rule configuration, 0–48 hours for integration using pre-built adapters, and immediate production scaling.

Yes — built for enterprise throughput and reliability. Nected supports horizontal scaling, backpressure handling, and SLA-backed uptime. Run thousands of concurrent scoring requests with millisecond decision latency and predictable performance; proven to scale to 100k decisions/min in production architectures.

Enterprise-grade controls and auditability. Role-based access, field-level encryption, full audit logs, data residency options (on-prem, private cloud), and GDPR/SOC2-ready processes. Nected stores only the decision metadata by default; you control sensitive PII persistence policies via connectors.

Invocations refer to the number of times your workflows/rule is triggered via API, cron or other trigger. It will count the parent rule/workflow and can have as many rules, nodes within it. This metric is often used for billing purposes. Compared to other products, invocations as a billing metric can be more cost-effective and transparent, aligning closely with your actual usage and needs. It ensures you pay for the value you receive, rather than flat rates or less relevant metrics.

If you exceed, you'll be charged based on additional usage and will be added in your monthly charge. In case of payment failure after grace period, your plan will be reverted to free trial limiting your monthly execution and # of rules/flows as per free plan, however all your existing rules/workflow data would be kept intact.

Firstly, we do not have a vendor lock-in, so you can cancel anytime you want. However, if you decide to cancel once your subscription for a given period has started then you would be able to cancel at the time of the next billing cycle only.

Yes, you can typically upgrade your Nected plan at any point during your billing cycle. The upgrade process is usually straightforward, often involving just a few clicks in your account settings. Upgrading mid-cycle may involve prorated charges for the higher-tier service.

The best plan depends on your specific needs, such as the expected number of invocations, the complexity of your workflows, and the level of support you require. It’s a good idea to start with a basic plan and upgrade as your needs evolve, especially if you're new to Nected. Moreover, you can also write to us at assist@nected.ai and we will help you figure out the best plan for your brand.

Yes, Nected usually offers assistance in setting up and creating a Proof of Concept (POC), especially under certain plans. This assistance can include access to customer support, documentation, and possibly dedicated account management.

The Startup and Growth plans typically provide basic to enhanced support, including access to customer service through email or chat, a knowledge base, and possibly community forums. Response times and the extent of personalized assistance may vary between these plans.

The on-premise plan generally offers the most comprehensive support, including dedicated account managers, 24/7 support, and tailored assistance for deployment, maintenance, and troubleshooting. This plan is best suited for businesses with extensive, mission-critical use of Nected.